Despite the fact that women are more responsible with their financial commitments, a study by the MIPP Millennium Institute showed that under equal conditions, they are deprived of access to this financial instrument.

Consumer loans are part of the financing of Chilean families; however, access to these loans presents vices of inequality by incorporating gender variables, as demonstrated in the joint research of the Commission for the Financial Market (CMF) and the MIPP Millennium Institute.

“There is evidence that men are more likely than women to access consumer loans, as well as benefiting from lower rates, even though it has been documented that women are better payers,” explains Raimundo Undurraga, a researcher at the MIPP Millennium Institute and academic of the Department of Industrial Engineering, University of Chile.

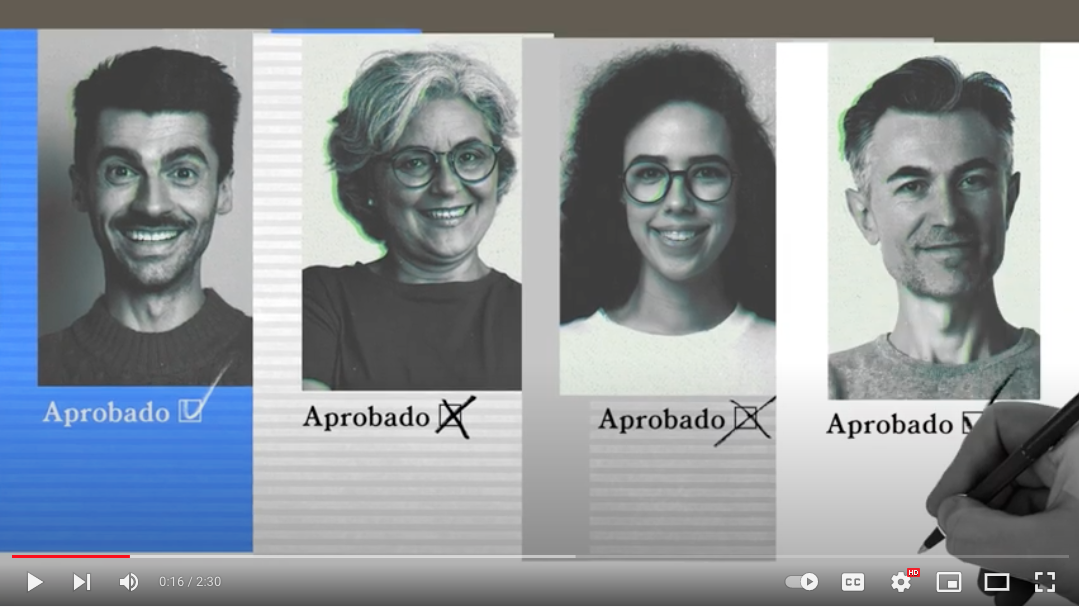

In the video, the reasons that assign a higher rate of credit granting to men than women are exposed, despite the fact that women show a better payment behavior. To discover why this discrimination is being generated, the researchers constructed credit requests of similar amounts and terms to be sent randomly to male and female executives. In terms of the responses to the requests, there are no differences between men and women. However, when looking at credit approval rates, women are 6% less likely to be approved than men.

To provide more information about this study, as well as the work conducted by the MIPP Millennium Institute, the research center launched a series of videos, which explain the different areas of its work and their impact on people’s lives:

MIPP Chile 2026